Mail wire frauds, a growing financial threat, target individuals and businesses through deceptive practices during breach-of-contract settlements outside court. Criminals impersonate legitimate entities, tricking victims into disclosing banking info for unauthorized fund transfers. To protect against these schemes, clients must verify requests, use multi-signature authorizations, train staff on fraud awareness, and monitor transactions carefully. Case studies highlight the importance of transparency, robust internal controls, and specialized legal counsel in mitigating risks associated with settling breaches outside court, where fraudulent attempts can lead to substantial losses.

“Mail wire fraud, a sophisticated form of cybercrime, poses significant risks in our digital age. This comprehensive guide delves into the intricate world of mail wire frauds, offering a detailed understanding from inception to detection. We explore the legal implications of settling breach of contract outside court, a strategy both beneficial and fraught with risks. Through real-world case studies, we uncover valuable lessons learned, providing essential insights for businesses to fortify their defenses against this evolving threat.”

- Understanding Mail Wire Frauds: A Comprehensive Overview

- Legal Implications of Settling Breach of Contract Outside Court

- Strategies to Prevent and Detect Mail Wire Fraud

- Case Studies: Real-World Examples and Lessons Learned

Understanding Mail Wire Frauds: A Comprehensive Overview

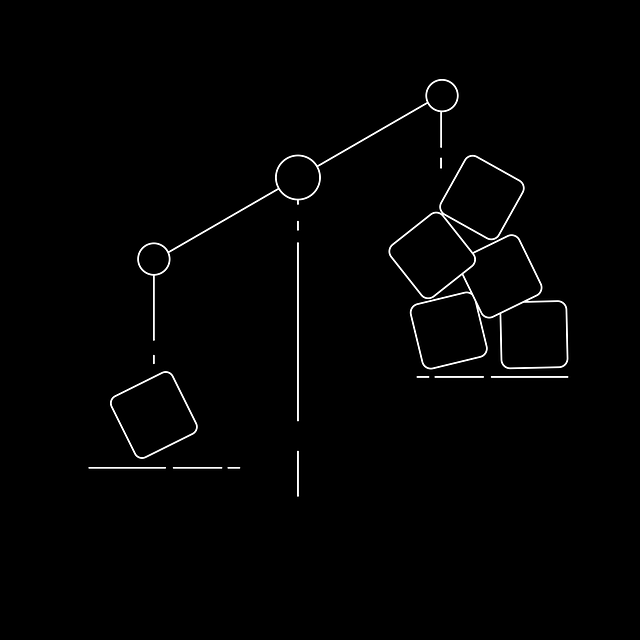

Mail wire frauds are a prevalent form of financial deception where criminals exploit the trust associated with electronic fund transfers to settle breaches of contract outside court. This deceptive scheme often involves impersonating legitimate businesses or individuals through phishing emails, text messages, or even phone calls. Once targeted victims provide their banking information, the fraudsters transfer funds from their accounts without their knowledge or consent.

These white-collar and economic crimes can have severe consequences for respective businesses and individuals alike. For his clients, it is crucial to stay vigilant, verify requests for sensitive information, and ensure that all communications regarding financial transactions are initiated by known and trusted sources. Understanding the tactics employed by fraudsters and staying informed about emerging trends in mail wire frauds is essential to mitigate these risks effectively.

Legal Implications of Settling Breach of Contract Outside Court

Settling a breach of contract outside of court can have significant legal implications. While it may seem like a quicker, more cost-effective solution compared to litigation, it could lead to unforeseen consequences. When parties choose an alternative dispute resolution (ADR) method, such as mediation or arbitration, they are essentially opting for a private and mutually agreed-upon process to resolve the issue. However, this does not automatically guarantee a complete dismissal of all charges.

In the context of white collar and economic crimes, where complex financial transactions and intricate legal networks are involved, settling outside court may not offer the same level of scrutiny and transparency as a formal trial. The investigative and enforcement process for such cases goes through multiple stages, ensuring that every angle is explored and all relevant evidence is considered. Therefore, any settlement agreement must be meticulously drafted and executed to avoid potential legal pitfalls and ensure fairness for all parties involved.

Strategies to Prevent and Detect Mail Wire Fraud

Mail Wire Fraud is a sophisticated crime that requires proactive measures to prevent and detect. One effective strategy is to establish robust internal controls, such as multi-signature authorization requirements for wire transfers. Additionally, regular staff training on fraud awareness can significantly reduce the risk of employee complicity or mistake.

For his clients, leveraging advanced surveillance tools and continuous monitoring of financial transactions across the country can help identify suspicious activities. Investigating any unusual requests promptly and involving law enforcement early in the process is crucial. The goal is to disrupt fraudulent schemes before significant damages occur. All stages of the investigative and enforcement process should be meticulously documented to facilitate settling breach of contract outside court, ensuring a swift resolution while mitigating legal complexities.

Case Studies: Real-World Examples and Lessons Learned

Mail wire frauds, a sophisticated form of financial deception, have left significant marks on both individuals and businesses alike. Case studies from real-world scenarios offer invaluable insights into the tactics employed by perpetrators and the strategies used to combat them. For instance, a recent case involved a white-collar defendant manipulating international wire transfers to settle a breach of contract outside of court. This approach, while attempting to avoid legal repercussions, backfired, leading to increased scrutiny from regulatory bodies. The respective business suffered substantial financial losses, underscoring the high-stakes nature of such crimes.

Through these examples, critical lessons emerge. First, transparency and robust internal controls are essential deterrents against mail wire fraud. Additionally, prompt reporting of suspicious activities to relevant authorities can mitigate potential damage. High-stakes cases often require specialized legal counsel adept in white collar defense strategies, ensuring that justice is served while protecting the interests of all parties involved.

Mail wire fraud remains a significant concern in our digital age, but with increased awareness and robust strategies, it’s possible to mitigate risks. Understanding these scams, their legal implications, and effective prevention methods is key. While settling breach of contract outside court can be tempting for cost-saving measures, it’s crucial to weigh the risks and consider professional advice. By learning from real-world case studies, businesses can fortify defenses and protect themselves from these insidious schemes. Staying vigilant and adopting proactive security measures are essential steps in navigating this complex landscape.